What Happens If Your Business Falls Behind on Payroll Taxes?

- Aug 15, 2022

Falling behind on taxes can lead to a lot of financial difficult for a business. If you fall behind on payroll taxes, however, you could be in even more trouble. In fact, the IRS has shut down companies for not paying these taxes, making it a very real threat to your company. So what happens if you do fall behind on your payroll taxes? Is there something you can do to save your business from a forced IRS closure? Keep reading to learn more.

Falling behind on taxes can lead to a lot of financial difficult for a business. If you fall behind on payroll taxes, however, you could be in even more trouble. In fact, the IRS has shut down companies for not paying these taxes, making it a very real threat to your company. So what happens if you do fall behind on your payroll taxes? Is there something you can do to save your business from a forced IRS closure? Keep reading to learn more.

What Are Payroll Taxes?

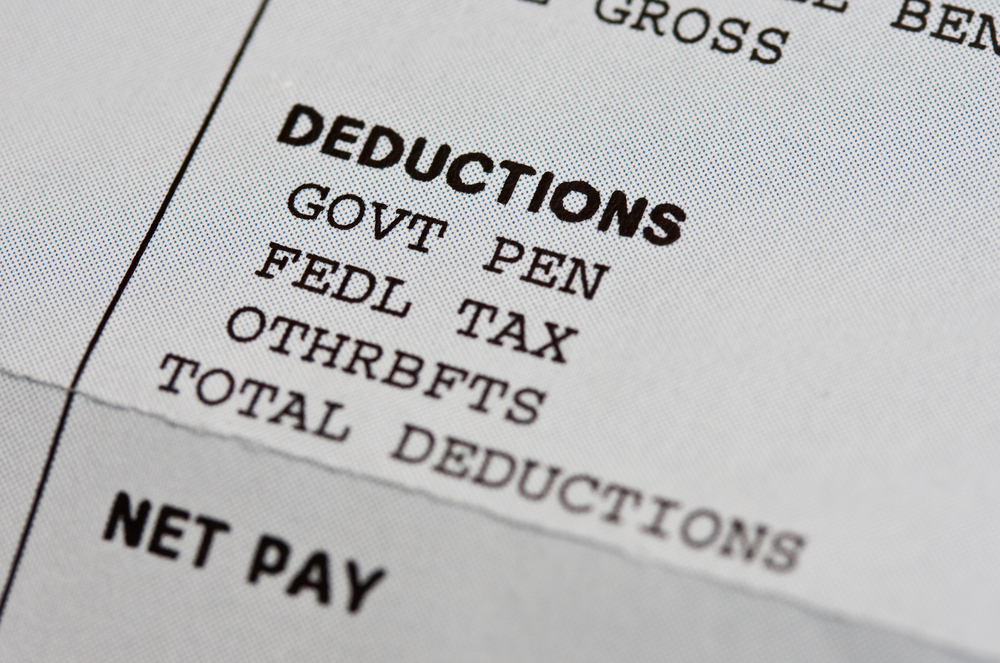

Payroll taxes are the FICA taxes (including Social Security and Medicare) and federal and state income tax withholdings that are automatically withdrawn from your employees’ paychecks. The amount that is withdrawn actually only represents half of the payroll taxes due to the IRS, however. The other half of the FICA taxes must be paid by you, the employer. Additionally, those income tax withholdings are actually automatically held by the employer, which means you are responsible for remitting those withholdings on a regular basis.

Collectively, these taxes are known as the trust fund portion of your total payroll liability—named as such because employers are entrusted with collecting and depositing those taxes on behalf of their employees. Failure to meet your payroll tax liabilities is taken very seriously, because those funds do not belong to the business, and failing to send them on to the IRS is effectually stealing from both your employees and the US government.

Of course, we recognize that business owners (especially first-time owners) may fail to pay their full payroll taxes due to miscalculations or simple errors. Nonetheless, the IRS will take these mistakes very seriously, and it’s important to take corrective action as soon as possible if it occurs to protect your company.

What Happens If You’re Late?

The IRS will very quickly inform you if you’re late on remitting your payroll taxes. They’ll impose a deposit penalty against your business if your payroll taxes are not paid on time, or if they’re not paid in full. The exact amount of the penalty will vary based on several factors. However, it typically starts at 2% if the deposit is one to five days late. It increases to 6% when the deposit is six to fifteen days late.

You will then receive a notice regarding the missing deposits. You will have ten days from the date of the letter to submit the full amount you owe, along with a 10% penalty. After this period has passed, a maximum penalty of 15% will be applied.

In some cases, the IRS may be willing to waive the deposit penalty for a missed payroll deposit if there is a reasonable cause for the late deposit, and it was not missed due to willful neglect. However, to increase your chances of getting this fee waived, we recommend working with an experienced tax professional.

What If You Intentionally Withhold Payroll Taxes?

While the IRS may be willing to waive penalties for a reasonable mistake, they’re far less lenient on businesses that intentionally withhold payroll taxes. If this happens, the IRS can leverage a trust fund recover penalty that is equal to 100% of the employee’s share of taxes. Additionally, they can assess you, the employer, with a criminal fine of up to $10,000 and even up to five years in prison.

The IRS will attempt to collect the trust fund recovery penalty from all responsible persons, which can include the employer as well as any employee responsible for collecting and depositing the payroll taxes to the government. All of these individuals can be held jointly and separately liable for the penalty. This can include a payroll company or third-party accountant who was responsible for remitting the withholdings. While you might feel that you should not be held responsible for a third-party company’s failure to remit the withholdings, the IRS still places this burden squarely on the employer’s shoulders.

Again, this penalty is only applied if the IRS can show that you willfully failed to remit the payroll taxes. This means that you knew what you owed, knew that keeping that money for yourself was wrong, and you did it anyway. For example, you might use withheld payroll taxes to invest in new equipment for the business, confident you’ll make that money back before the payroll taxes are due, only to end up without the necessary funds when it’s time to remit those payments. Though you may not have intended to be left short of cash, you willfully used payroll taxes for your business, and would be subject to the trust fund recovery penalty.

Resolving Your Delinquent Payroll Taxes

As you can see, falling behind on your payroll taxes is very serious, and it’s important to pull yourself out of that hole quickly. Contact the IRS Advocates today to learn how we can help your business get out from under this tax debt before your company is forced to close its doors forever.

STOP THE IRS!

Settle for less & Protect your assets

Never Call the IRS without Speaking with our Pros First!